MAIN FEATURES

StereoTrader is a scalable Interface for MetaTrader 4/5. Designed for professional Trading of CFDs, Futures and the Forex-Markets.

The platform supports manual Trading with unique Features as well as fully automated Processes.

NETTING OR HEDGING? BOTH!

StereoTrader enables for netting and accumulation with MetaTrader 4 and 5. This is unique.

Traders choose between accounting in either Stereo Future Mode (like Ninjatrader, Nanotrader, etc.), Stereo Hedge Mode (StereoTrader exclusive), Single Hedge Mode (MetaTrader4 standard) and Single Net Mode (various Platforms).

ISOLATED STRATEGIES

Multiple strategies with one instrument, one account at the same time within multiple charts. Each chart shows only those orders and statistics which belong to the underlying strategy.

No more need for multiple accounts, multiple installations or usage of other derivates than CFD.

HISTORY TRADING

Evaluation of trades, strategies and indications using historical data becomes available.

Perfect for increasing the learning process, perfect for webinars or seminars and last but not least – to meet all the features of StereoTrader without waiting for quotes.

TRUE ONE-CLICK-SPEED-TRADING

More than 35 (!) different trading commands are available at one single click and at highest visual precision.

Manual trades within just seconds become possible while scalping automations efficiency and profit at the same time.

INTELLIGENT ORDERS

Innovations suchs as the meanwhile legendary Limit-Pullback-Order or Market-Trailing-Order provide the potential to increase profits and to reduce risks drastically.

MIT orders (markets of touched) for synthetic stops, take profits and all kinds of spending orders.

On top: Trailing and attributes like OCO (once cancels other), reverse or net.

DESIGNED FOR METATRADER 4/5

Useful indications for day-trading and plenty of Add-ons are alread integrated and available at one single click.

The seamless principle avoids any interruptions by messages or popups which covers the chart. Floating panels organized in stacks help to stay focused. Different themes suit different tastes.

HIGH-LEVEL AUTOMATION & INDICATION

StereoMQL is a high-level framework, easy to read and based on MQL4/5. This allows a simultaneous creating of robots and indicators for MT4 and MT5 – without modifications.

The outstanding Estimator shows backtesting results on the fly. This unique feature increases the testing and development of strategies drastically!

Complete strategies, customized exit rules or individual trailing stops – everything is possible, either based on ticks or on finished bars.

ALGORITHMIC TRADING

Minimizing the risk by up to 50% without cutting the gained profit.

Strategic orders based on algorithms are able to trade the noise automatically and to create profits in non-trending markets.

Such algorithms may also be executed based on customizable zones and are allowing successful trading of only tendencies.

DOM CHART-TRADING (FUTURES)

The MT5 version is ready to trade futures.

The integrated Chart-DOM enables quick and precise trading with the market book directly from the chart.

A classic volume profile indication is also integrated.

EXIT RULES

Automated exits by various intelligent trailing stops based on different logics.

Also exiting by time, by equit or by real Trade P/L which includes any particular closings and new orders in between.

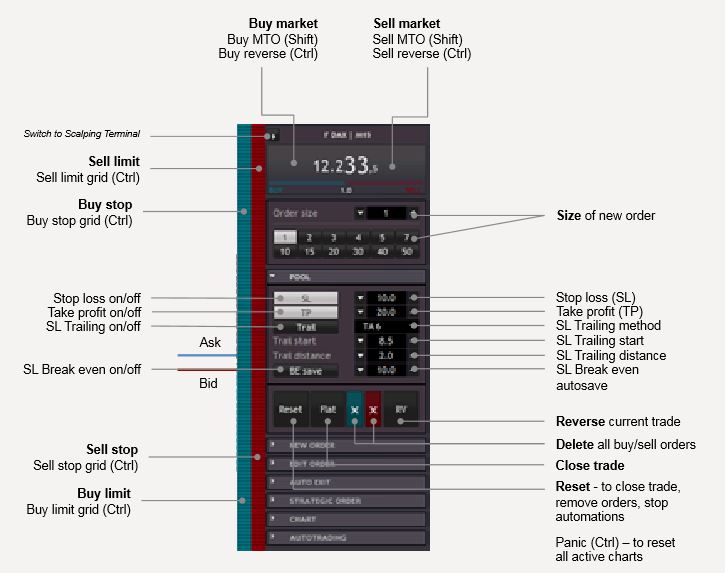

MAIN TERMINAL

Openening a market order is done by a single click onto the pice display, left side for long, right side for short. The spread is always displayed below the price and warns with another color, when spread goes above a definable threshold. Holding down the Control-key while cklicking forces a parallel closing of any opposite positions.

Besides normal ordering, StereoTrader provides intelligent Chained Order Grids within a specific distance and an optional progression respectivly for stop- and limit-order. Such a series, e.g. for set of limit buy orders can be placed by one Ctrl-Click below the price line. Due to chaining, such a grid is never filled at once.

Pure visual and intuitive trading at highest possible precision.

The floating-design-principe guarantees a trading process without any interruptions by message boxes or any other windows which cover the chart or prevent the trader from trading in any way.

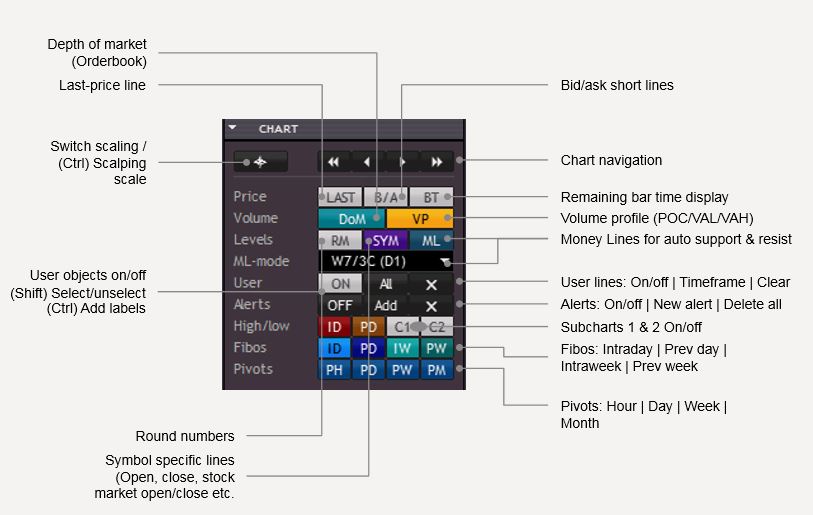

AUTO CHARTING

A further, certainly important companion in daily trading is the extended, automated charting of the StereoTrader.

Almost everything that is needed in daily trading can be switched on here with just one click.

Almost everything is included here and is updated in real time, from marks for the opening or closing of the exchange, Fibos and pivots for different time periods, round price marks to market depth and volume profiles.

The ability to limit trading times of instruments also allows the customized calculation of all indications for the selected time span.

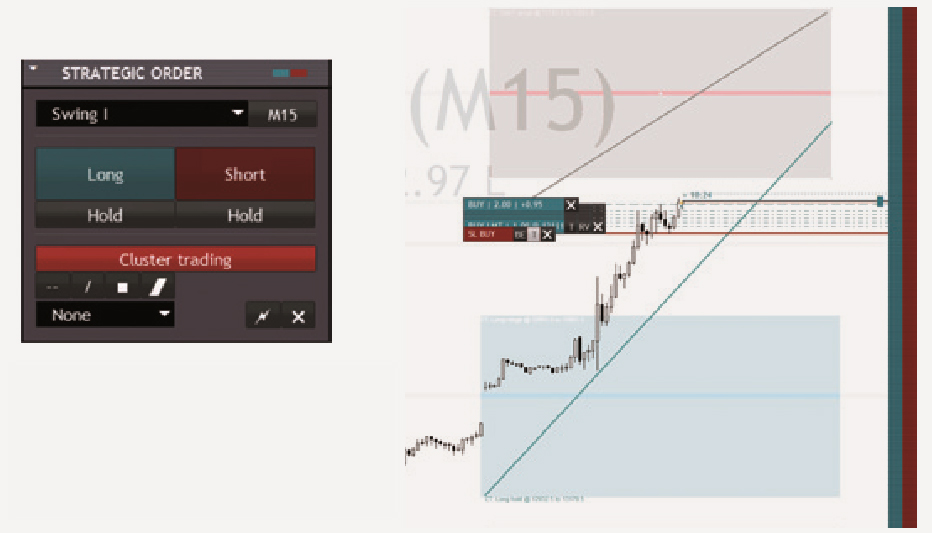

ALGO-TRADING

Besides standard ordering by sending a market order or placing pending orders, StereoTrader comes with some order algorithms which are able to beat any standard CFD order.

These algorithms are embedded in the Strategic Order panel. The buttons “Long“, “Side” and “Short” open a set of orders according to the assumed direction and based on the selected algorithm.

The sense behind this algorithmic ordering can be explained by a simple example:

October ,1st 2015. Trader A and trader B, both decide to go long for a swing in German DAX. Trader A uses normal CFD platform, trader B uses the strategic order preset “Swing” of StereoTrader MT.

Trader A risks 5 USD per point, trader B starts with 20 Cent per point.

The start price of DAX is 9.765 points, the end price on December, 4th 2015 after a small crash is at 10.872 points. These are the results:

Trader A (CFD) profit: 5.638 USD with one contract. Initial drwdown 1.375 USD, max drwdown 2.082 EUR. Paid spread 10 USD by assuming 2 point.

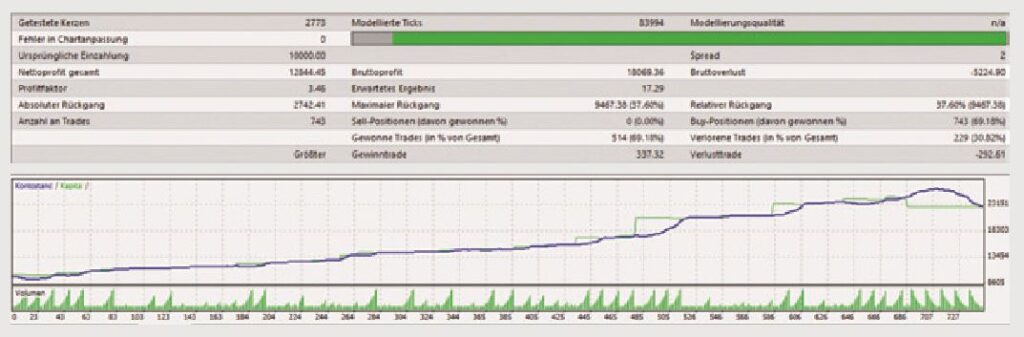

Trader B (StereoTrader MT) profit: 12.844 USD with 743 contracts total. Inital drawdown 1.375 USD, max drawdown 2.742. Paid Sread 5.224 USD.

In other words: Approximately double profit by same risk by just using a standard preset.

Another topic with Strategic Orders is, that such algorithms can be combined with customizable zones.

This was its possible to automate scenarios without the need for programming.

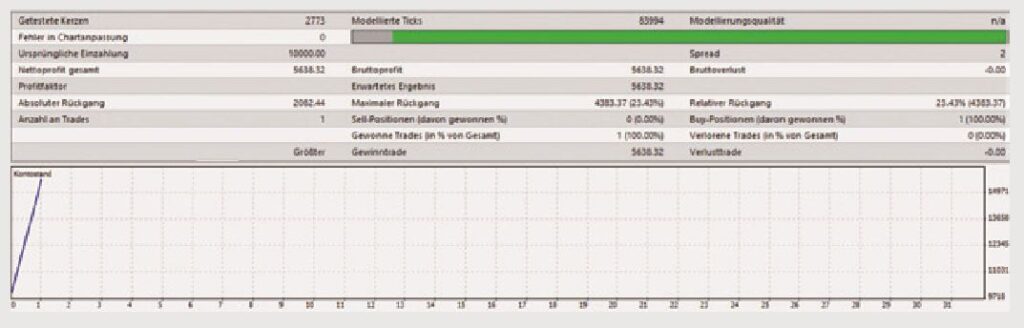

AUTOMATION | API

An API (advanced programing interface) for fast and efficient creation of indicating expert advisors (SEAs) is provided.

The built in Extimator allows backtesting of strategies in realtime at full visual control. As soon as the user changes any setting at the panel, the backtesting result updates within seconds (see picture).

Three slots are provided for parallel usage of up to 3 automation processes may be fully automated strategies, filters or any remote automation fot the platform.

StereoMQL, an easy-to-learn high-level development class (based on MQL5), reduces the effort, which is necessary to create any automation process to an absolute minimum, but the same time a maximal result is achievable.

ISOLATION OF STRATEGIES

Wihtin hedging accounts, StereoTrader allows for trading of multiple strategies at the same time, with the same underling and on the same account – without influencing each other, neither mathematically nor visually.

The screenshot demonstrates this. The left side shows a midterm session in DAX using M15 period, the right charts shows a scalping strategy. Not only the statistical data is complete different, but also the trade lines on the chart.

Of course this also makes it possible to trade automated and manually at the same time.

CUSTOMIZABLE DESIGN

StereoTrader MT comes with a predefined set of chart themes and layout styles as well as an automated mode which adapts the user defined colors of the charts.

Furthermore the graphical engine of StereoTrader is vector based and by this fully scalable. This allows for usage of the platform with standard resolution monitors as well as high resolution screens at maximal sharpness.